Better safe than sorry

You may think that with all of the other problems the government is dealing with they don’t have time to worry about whether you did you taxes right. However, the opposite is true.

You may think that with all of the other problems the government is dealing with they don’t have time to worry about whether you did you taxes right. However, the opposite is true.

In the last 10 years the IRS has more than doubled the amount of audits it conducts. It uses a complicated formula to decide who it will audit, but there are a few steps you can take to decrease the chances that it will be you.

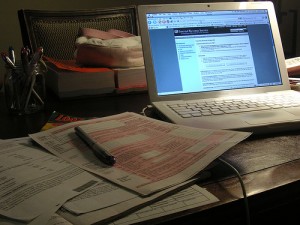

Take advantage of technology

There are plenty of web sites out there that will let you submit your taxes online. Filing electronically is helpful in a lot of ways. Forgetting to sign tax returns is a very common mistake, but tax software and web sites won’t let you submit a return without an electronic signature.

Most sites and software programs also have built-in programs that check for mistakes on your paperwork so you can catch and correct mistakes before you submit your taxes.

Keep track of donations

Taxes are a good example of a time when doing the right thing can come back to bite you. Deductions for large charitable donations will raise red flags for the IRS. Average charitable donations are usually no more than 2 percent of a person’s income. If you have donated more than that, make sure you explain what the donation was for and why it is so big. Also, it’s very important to include receipts.

Proof to back up big deductions

Other large deductions will raise red flags, too. Many medical bills can ean deductions, but if you have an especially large medical bill that amounts to a large deduction, make sure you have careful documentation. Make sure you have copies of your bills, especially they amount to more than $50,000.

If you’re itemizing reductions, remember that any deductions for meals or entertainment that cost more than $75 require a receipt. ... click here to read the rest of the article titled "Tips for Tax Time | Know the Rules, Avoid an Audit"

No comments:

Post a Comment