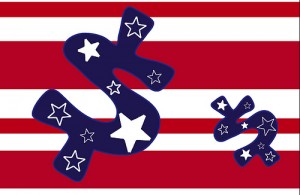

Fed plans to profit from loans

Well, it seems the feds are so fed up with the lending world, they’ve decided to take matters into their own hands.

Well, it seems the feds are so fed up with the lending world, they’ve decided to take matters into their own hands.

The Federal Reserve and the U.S. Treasury have started a new program through which consumers and businesses can take out loans directly from them.

Know your acronyms

The program is called the Term Asset-Backed Securities Loan Facility, otherwise known as TALF.

Through TALF, people can borrow money based on ABS (asset backed securities). That means they can get business loans or personal loans backed by consumer loans, auto loans, student loans, credit-card receivables or small-business loans.

Not a new idea

This program was first announced in November, but it was delayed. Now, owners of ABS can apply for loans starting March 17. The first TALF loans will be issued March 25.

Making a mint

The program could provide up to $1 trillion in loans for consumers and small businesses. It is designed to make a profit through interest and fees.

The plan is to stimulate the economy without relying on traditional credit channels, which are now blocked up, the government said.

A reluctant industry

Banks are unable or unwilling to lend, and even customers with high credit scores are finding credit hard to obtain.

“Issuance of consumer ABS has remained near zero since October,” the Treasury said, adding that the stress in the market for extending credit to consumers “is one of the causes of the deepening recession.” ... click here to read the rest of the article titled "New Government Program Offers Loans to Individuals, Businesses"

No comments:

Post a Comment