Well, I sold my first stock. I agonized over when would be the right time, but then I just pulled the trigger, anyway.

Earlier this year, I started using the “free money” I was getting from this credit card to buy some stocks.

In March, we paid our tax bill of over $3,300 using that card, so the 2% rewards were higher than normal. I asked a friend of mine who knows a lot more about the stock market than me what stocks were catching her eye, and on her unofficial recommendation I bought 60 shares of CAR, the Avis car rental people.

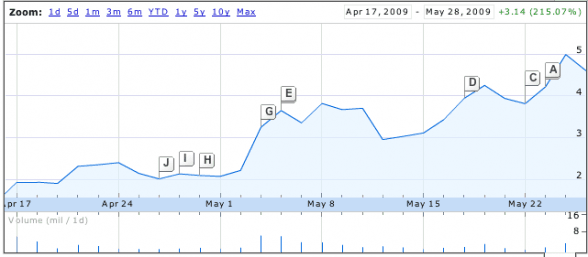

That was April 17th. The stock price was $1.50. With a $9.95 commission at Sharebuilder, I ended up “spending” a total of $99.95.

And then I watched as the stock price just rose and rose and rose.

On about May 20th I started wondering if I should sell my proceeds. We’ve had rather more pet problems than usual and I was a little worried that our upcoming vacation might suffer as a result. The “overall return” on that investment, according to Google Finance, was hovering around 200%, which is a heck of a lot more than the 7 to 9% we’re taught to expect from long-term investments.

So I sold it on May 27th. I was a bit alarmed to see that there was yet another commission of $9.95. To me, that’s like paying a toll over a bridge going in each direction.

Stock proceeds: $282.24

Minus original investment of $99.95: $182.29

Now, if I’m reading this Capital Gains Tax table correctly, we’re going to be hit with a 25% of the “cost basis” come next April. If the cost basis is the amount I spent on the investment, that’d be the $99.95 number again, which means a tax of about $25.

Profit minus upcoming tax: $157.29

So I spent $99.95 and got $157.29, a real profit of 157%. Not the nearly 200% that Google Finance was teasing me with, but not shabby, either.

The other way to look at it is that since the $99.95 was free money in the first place, I made a profit of infinity dollars.

More importantly, when we take our vacation next month, we’ll have $157 that we otherwise wouldn’t have had. That’s one fancy dinner with some very good wine. I’m looking forward to it.

The Consumerism Commentary Podcast is in full swing with new episodes every Sunday. Listen and subscribe now!

Read more of Smithee's First Stock Sale…

No comments:

Post a Comment